By: Kayla Huynh

Throughout my life, I’ve always tried to make smart money choices. Preparing for retirement is no exception. So, I sat down with our Financial Planning Manager, Joe Burhmann, who taught me how to be SMART when it comes to preparing for my future.

S – start saving now

No matter what stage of life you’re in, taking steps toward retirement today is important.

Newer in your career?

As a young adult, I’ve been more focused on starting my career than planning for what I might do when it ends. That’s one mistake young people often make, but they should actually start saving for retirement as early as possible.

Further along in your career?

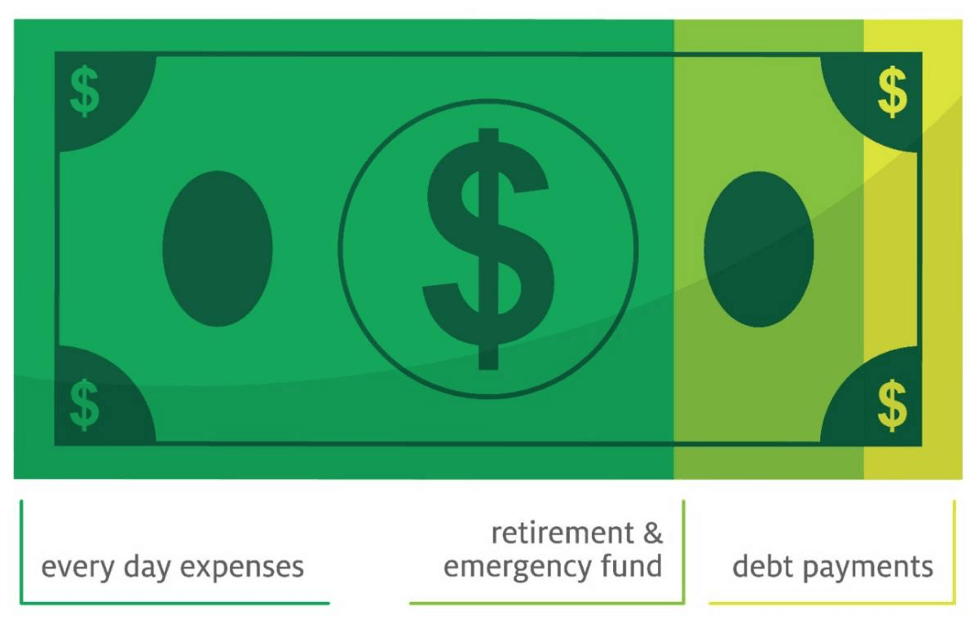

If you don’t have as much time on your side, it’s not too late to start saving today. Buhrmann suggests using the 70/20/10 method to find ways to cut back on expenses that can instead be put toward retirement each month.

This involves living on 70 percent of your take-home pay, saving half of the 20 percent on retirement, and the other half on your emergency fund and short-term goals. Then, use the last 10 percent of your monthly earnings to aggressively pay off any debt.

M – maximize your employer match

A 401(k) (or similar defined contribution plan) allows employees to invest part of their paycheck for retirement on a pre-tax, and in some cases, after-tax basis.

Your employer may match your contributions to a 401(k) up to a certain dollar amount or percentage. If you can, be sure to contribute at least enough to take full advantage of the match so you’re not leaving ‘free money’ on the table.

A – allocate your money

Buhrmann compares “allocation” to a buffet line – you want a little bit of everything as part of a balanced diet!

It can make sense to allocate (or spread) your money into different investments like: mutual funds, CDs, stocks, and bonds to diversify your holdings. There’s no one-size-fits all recommendation on how you should divvy these up, though. For instance, different investment and savings vehicles can help you work toward different goals depending how much risk you’re willing to take on and how far out retirement is.

R – rebalance your investment portfolio periodically

As your money ebbs and flows over time with these investments, you may have to adjust how much of each type of investment you have to keep it aligned with your overall plan to accomplish your goals. Periodically, track which of your investments are actively working toward your current objectives. Then, modify or balance the account if need be so your portfolio stays on track.

If I just said a lot of things that mean nothing to you, don’t worry, you’re not alone.

This is an area where financial professionals can help. Buhrmann says rebalancing your investments is similar to maintaining your car’s tires – even after getting new tires or inflating older ones, you will still need to check on them down the road and rotate them regularly to keep you safe, and keep the car performing well.

But, just like you take your car into the auto shop, choosing to leave your investment decisions to the pros is totally acceptable.

T – taxes: keep an eye on them!

It’s important to save tax-efficiently. Luckily, it’s pretty simple to take advantage of the tax options of some common retirement strategies.

Traditional IRAs and pre-tax deferrals to a 401(k) allow you to contribute before you pay taxes. However, because you’ll probably have to pay taxes at some point, those taxes will be taken when you withdraw money from your account.

If you prefer a tax break during your retirement years instead of up front, you may be able to take advantage of a Roth IRA. For a Roth IRA, you will need to pay taxes on your contributions upfront, but the earnings on your investments grow tax free. That means, when you’re ready to the money out during retirement, you won’t have to pay taxes again.

There’s a lot to consider when it comes to investing your money. The good news is, financial professionals can make those decisions easier.

In fact, according to a COUNTRY Financial Security Index survey,* people working with a financial planner were 11 percent more likely to say they set aside money for savings or investments than those going at it alone.

While the journey to retirement may seem like a long and winding road, remember to be ‘SMART,’ get started today, and don’t be afraid to ask for help.

Warrick Dunn Charities, Inc. is proud to partner with COUNTRY Financial as a part of our Count on Your Future program. COUNTRY Financial is a group of US insurance and financial services companies with customers in 19 states. The group of companies offers a range of insurance and financial products and services, including auto, home, life, commercial insurance, retirement planning, investment management and trust services. For more information on the latest COUNTRY please visit their website.